The Gift Trust has set up an account with US donor-advised fund RSF Social Finance to allow US based donors to contribute to charitable causes in New Zealand via The Gift Trust and receive a US tax benefit. The account is called “Friends of The Gift Trust NZ” and any donations to it will receive a US tax receipt and will be transferred to The Gift Trust in NZ quarterly, to be allocated for the purposes that the donor specifies. Donations can be made in cash, shares, or securities. The fund is intended to be used for donors who want to donate into a Gift Trust account.

How to donate into the US fund

To ensure your donation is allocated correctly to The Gift Trust and used for the NZ project you intend, fill the form HERE with the details for RSF and send it to: kayla.leduc@rsfsocialfinance.org

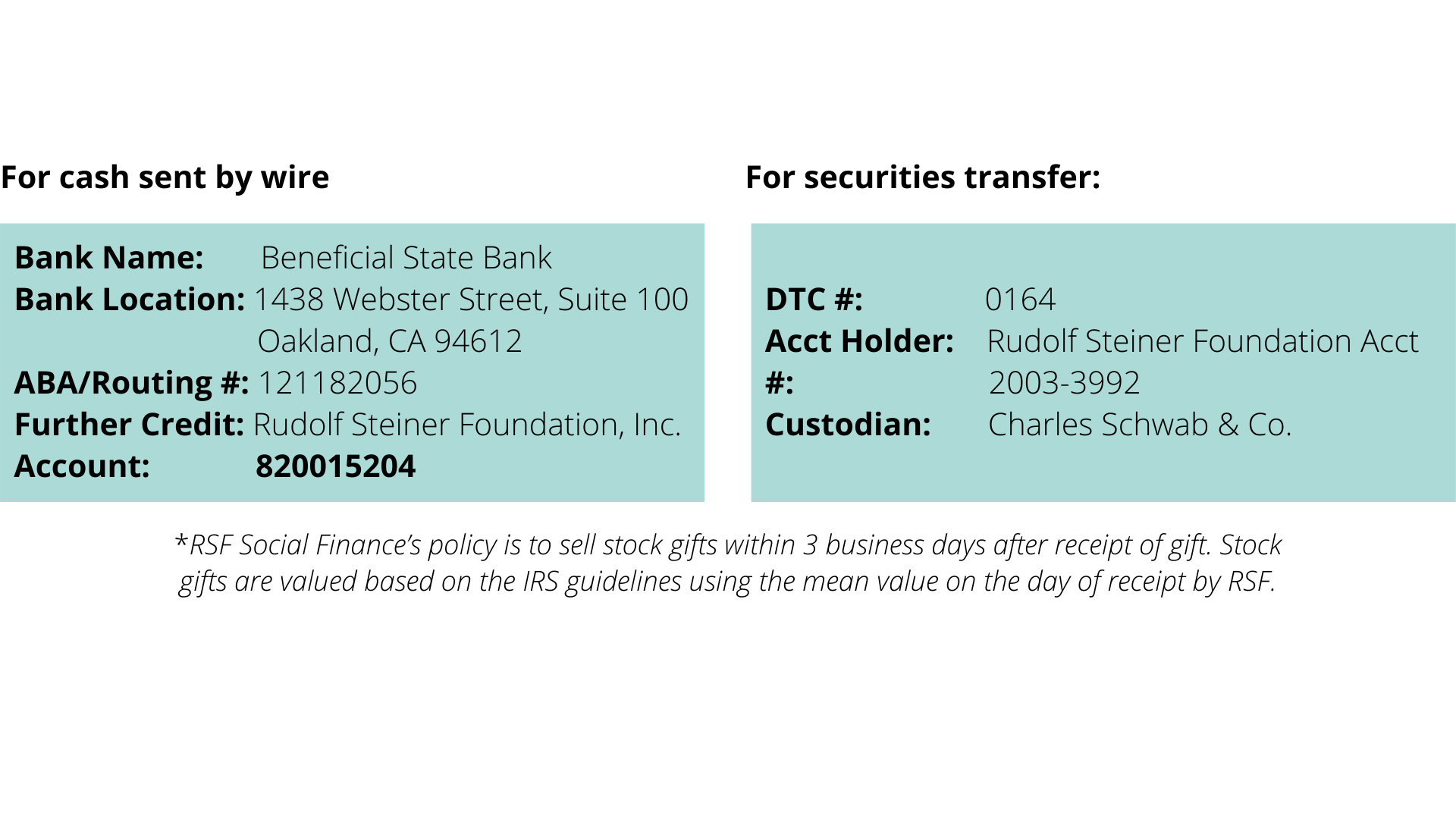

Wire Transfer or Stock Gift:

After filling in the above form, notify your bank or broker of the RSF bank and brokerage information:

By Credit Card:

You may give online by credit card HERE.

Select “Other” from the drop-down list and type “Friends of The Gift Trust NZ” – (and specify how you would like your donation to be used).

Fees

RSF Social Finance will deduct their fees before the donations are passed over to The Gift Trust. Their fees are 2.6% annually of the funds held, plus a transaction fee when they pay the donations over of US$350 per quarter (this transaction fee will cover all the donations transferred that quarter).

The Gift Trust charges its standard fees for servicing Gift Accounts – for any donations that are distributed in the same year this is 2%. If you are not donating into an existing Gift Account please speak to us first.